Tax Benefits Of Owning An Electric Vehicle. Electric vehicles offer many tax benefits that can save you money in the long run. You get a deduction of rs.

From 1 april 2020 until 31 march 2025 all zero. After colombia implemented these tax policies, we saw a major increase in electric vehicle sales.

According To The Internal Revenue Service, Electric Vehicle Owners Can Receive Up To A $7,500.

The 7 benefits of owning an electric vehicle electric vehicles are becoming more and more popular, and it's not hard to see why.

The Rates For All 100% Electric.

Meaning you can claim a reimbursement of up to 9p per mile for.

Discover Electric Vehicle Tax Benefits In The Uk With Connected Kerb.

Images References :

Source: selfdriveproject.com

Source: selfdriveproject.com

The Many Tax Benefits of Owning An Electric Vehicle Self Driving Project, As of the 1st of march 2023 the advisory electricity rate for fully electric cars is 9 pence per mile. The benefits of owning an electric vehicle come with perks, such as tax credits, access to hov lanes, and reduced parking fees in some areas.

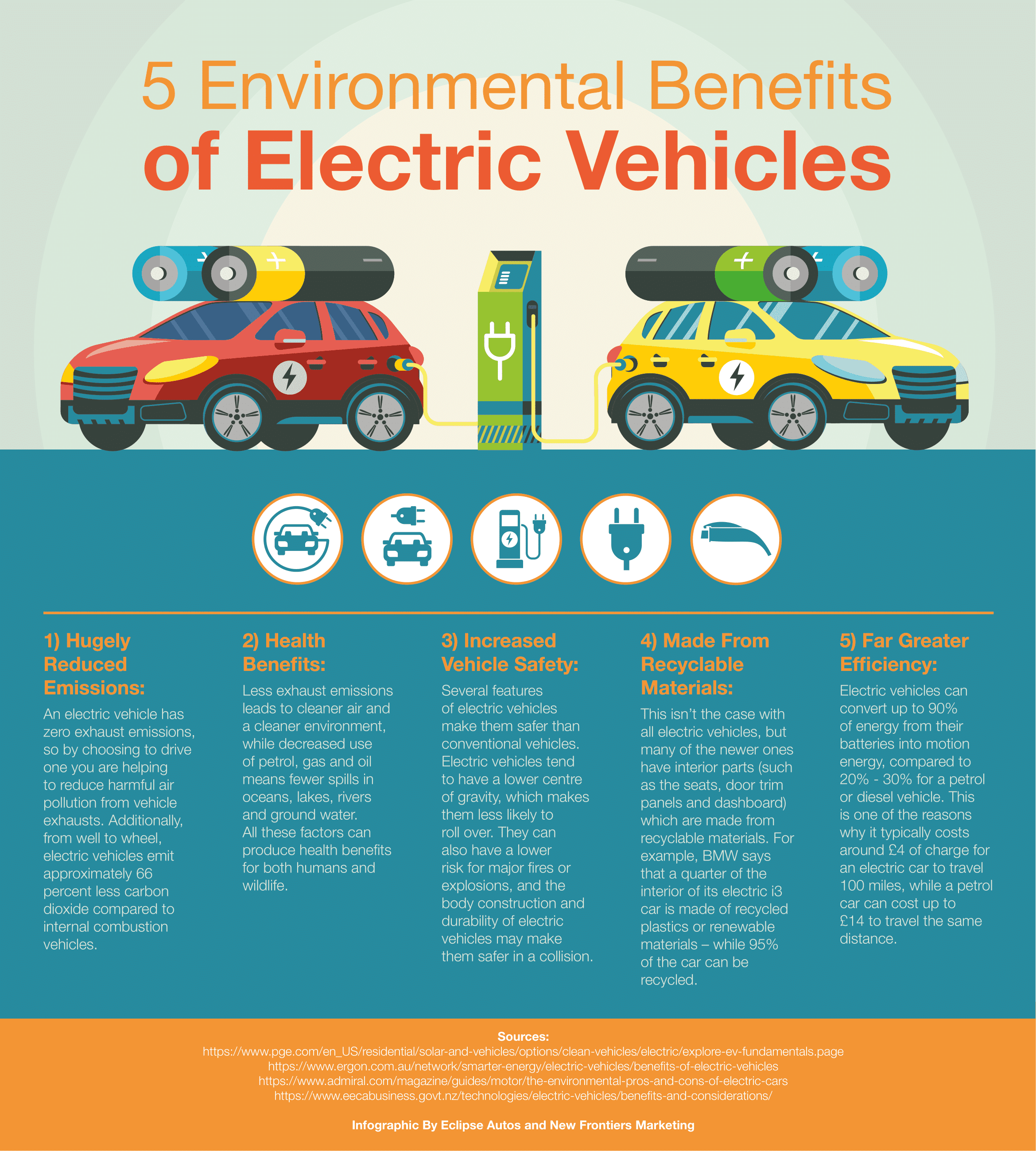

Source: www.eclipseonestop.co.uk

Source: www.eclipseonestop.co.uk

Infographic 5 Environmental Benefits of Electric Vehicles Eclipse Auto, If the vehicle is used for personal use as well as business then benefit in kind tax must be paid. Discover electric vehicle tax benefits in the uk with connected kerb.

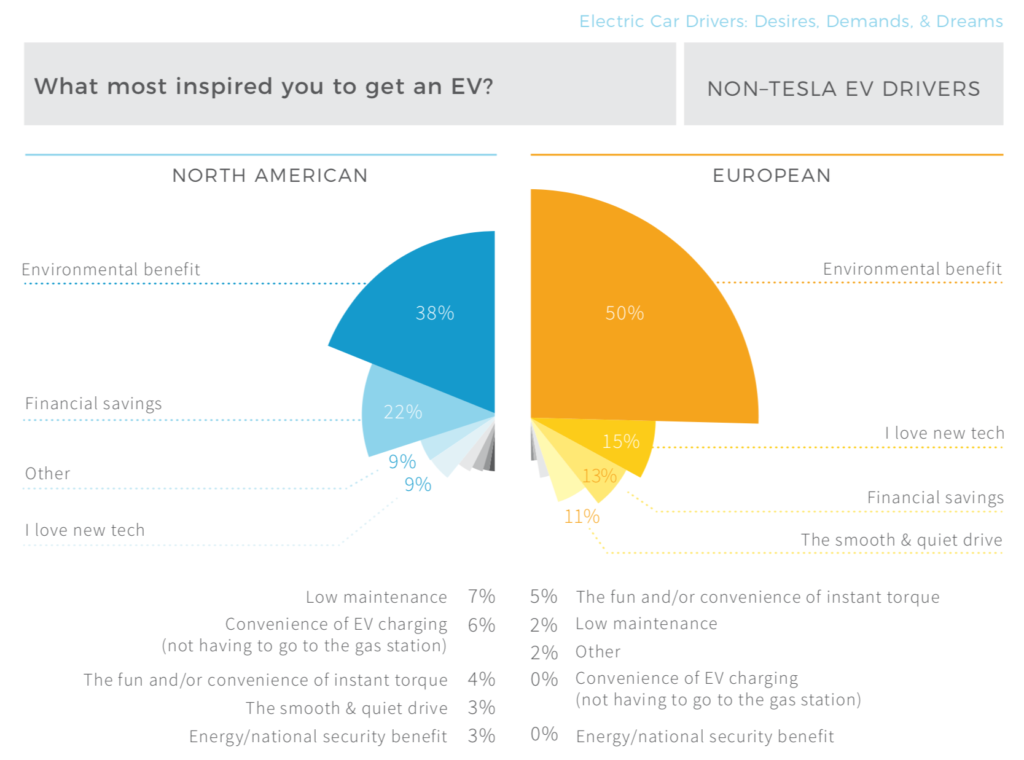

Source: www.myev.com

Source: www.myev.com

Benefits of Owning an Electric Vehicle, 1,50,000 under section 80eeb on the. Explore grants, exemptions, and savings.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, If the vehicle is used for personal use as well as business then benefit in kind tax must be paid. This makes electric vehicles very attractive for businesses and employees.

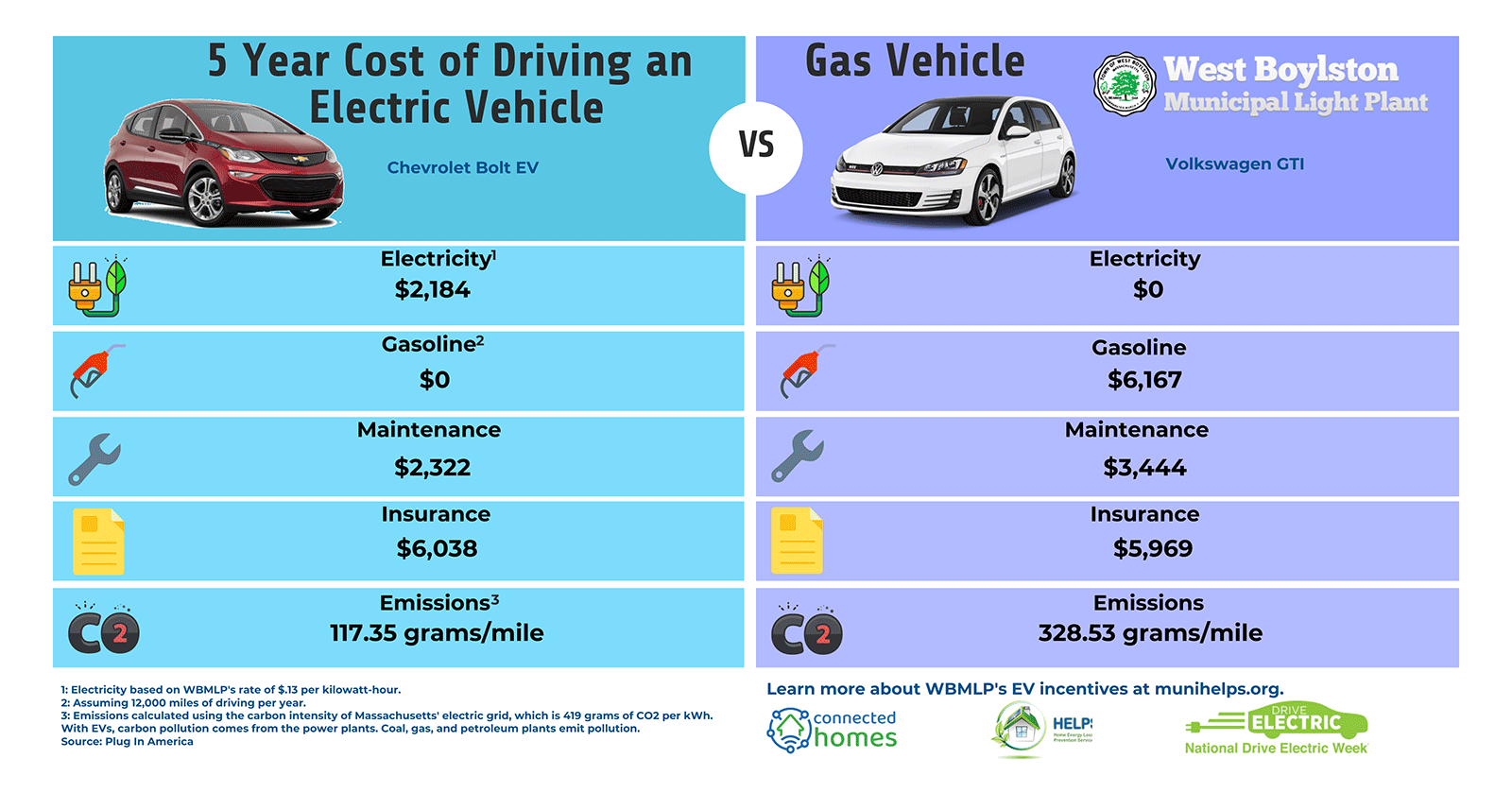

Source: wbmlp.org

Source: wbmlp.org

Electric Vehicle (EV) Incentives & Rebates, For your own use, not for resale 2. According to the internal revenue service, electric vehicle owners can receive up to a $7,500.

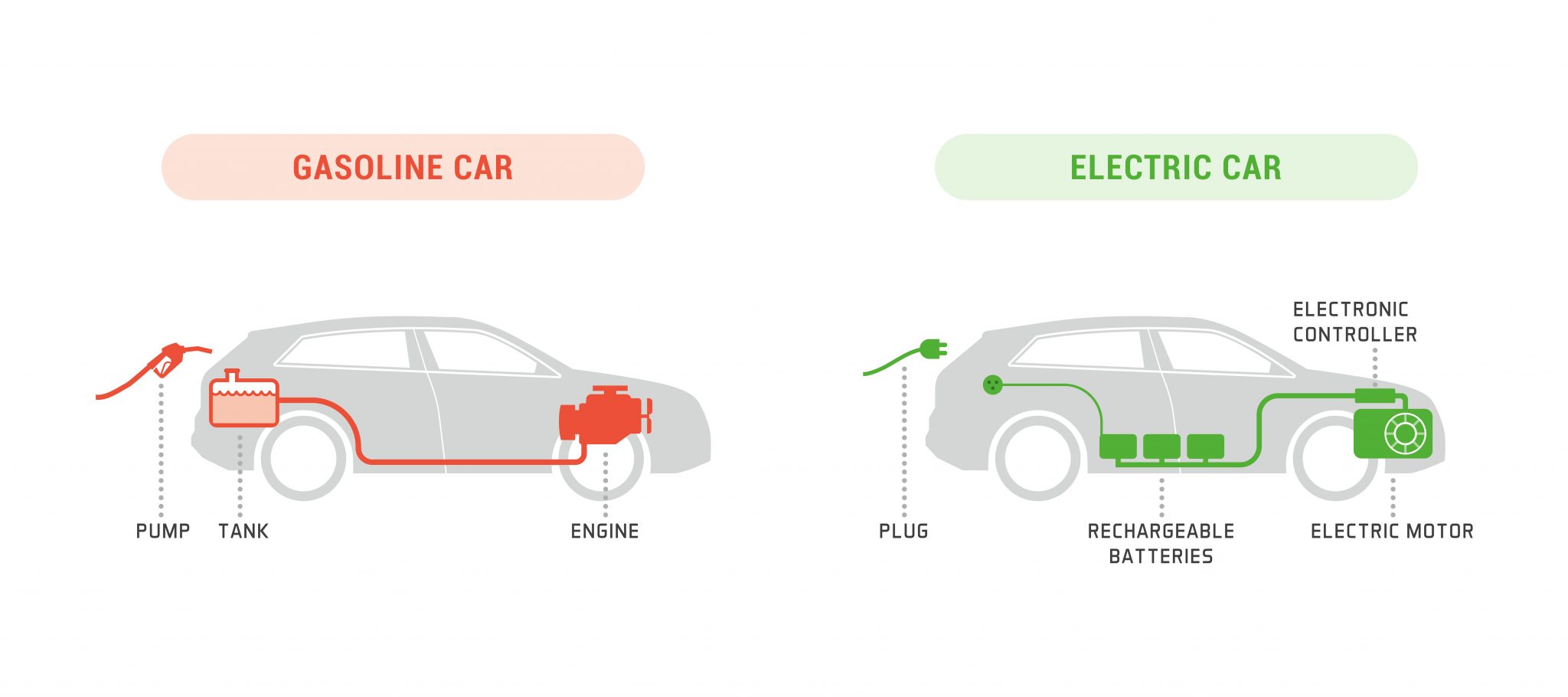

Source: www.sungenia.com

Source: www.sungenia.com

Advantages of Electric Vehicles Sungenia Solar, For your own use, not for resale 2. However, you can continue to apply the.

Source: www.bobvila.com

Source: www.bobvila.com

11 Hidden Costs of Owning an Electric Car Bob Vila, The 2024 electric vehicle tax credit has been expanded and modified. Rules and qualifications for electric vehicle purchases.

Source: www.autoglass.ie

Source: www.autoglass.ie

The Pros and Cons of Owning an Electric Car Allglass® / Autoglass® Blog, The 2024 electric vehicle tax credit has been expanded and modified. According to the internal revenue service, electric vehicle owners can receive up to a $7,500.

Source: www.womenonwheels.co.za

Source: www.womenonwheels.co.za

Pros and cons of owning an electric vehicle, The 2022 update of acea’s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 eu member. The 2024 electric vehicle tax credit has been expanded and modified.

Source: alexanderknightaccountants.co.uk

Source: alexanderknightaccountants.co.uk

Electric car tax breaks for company directors Get your FREE guide, This makes electric vehicles very attractive for businesses and employees. The 7 benefits of owning an electric vehicle electric vehicles are becoming more and more popular, and it's not hard to see why.

As Of The 1St Of March 2023 The Advisory Electricity Rate For Fully Electric Cars Is 9 Pence Per Mile.

If the vehicle is used for personal use as well as business then benefit in kind tax must be paid.

This Makes Electric Vehicles Very Attractive For Businesses And Employees.

Many european countries offer fiscal support to stimulate market uptake of electric cars, but these tax benefits and purchase incentives differ widely.