Ga Tax Rates 2024. As of monday, the new year brought in a new tax rate, lowered from an income tax of 5.75% to 5.49%. The new employer rate is 2.7%, up from 2.64% in 2022.

Yards), state tax is included in the jurisdiction rates below. Georgia payroll taxes for 2024.

Georgia's 2024 Income Tax Ranges From 1% To 5.75%.

The bill calls for the flat rate to drop beginning in 2024 and continue to drop to 4.99% in 2029.

In Georgia, Taxpayers Can Claim A Standard Deduction Of $5,400 For Single Filers And $7,100 For Joint Filers For The 2023 Tax Year.

Georgia’s unemployment insurance tax rates for 2024 range from 0.04% to 8.1%, the state labor department confirmed to bloomberg tax on jan.

The Tax Rate Is Set To Decrease Each Year Until It Reaches 4.99%, But Changes Can Be Delayed.

Images References :

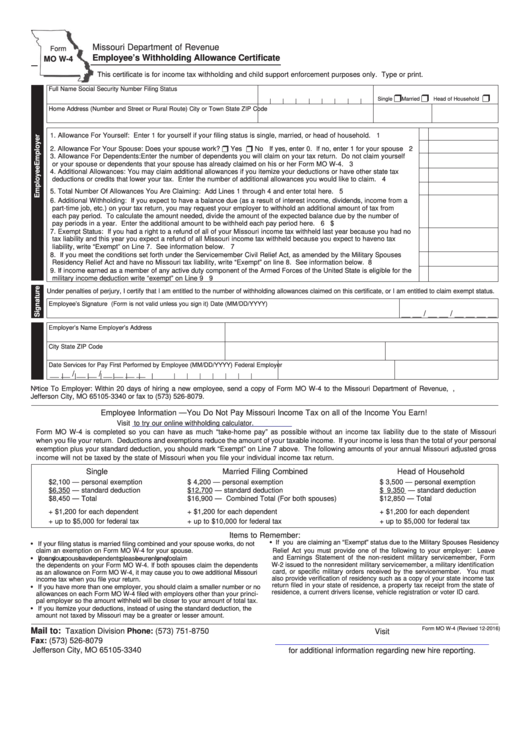

Source: www.withholdingform.com

Source: www.withholdingform.com

2022 Ga Tax Withholding Form, 1%, 2%, 3%, 4%, 5% and 5.75%. Georgia sales and use tax rate chart.

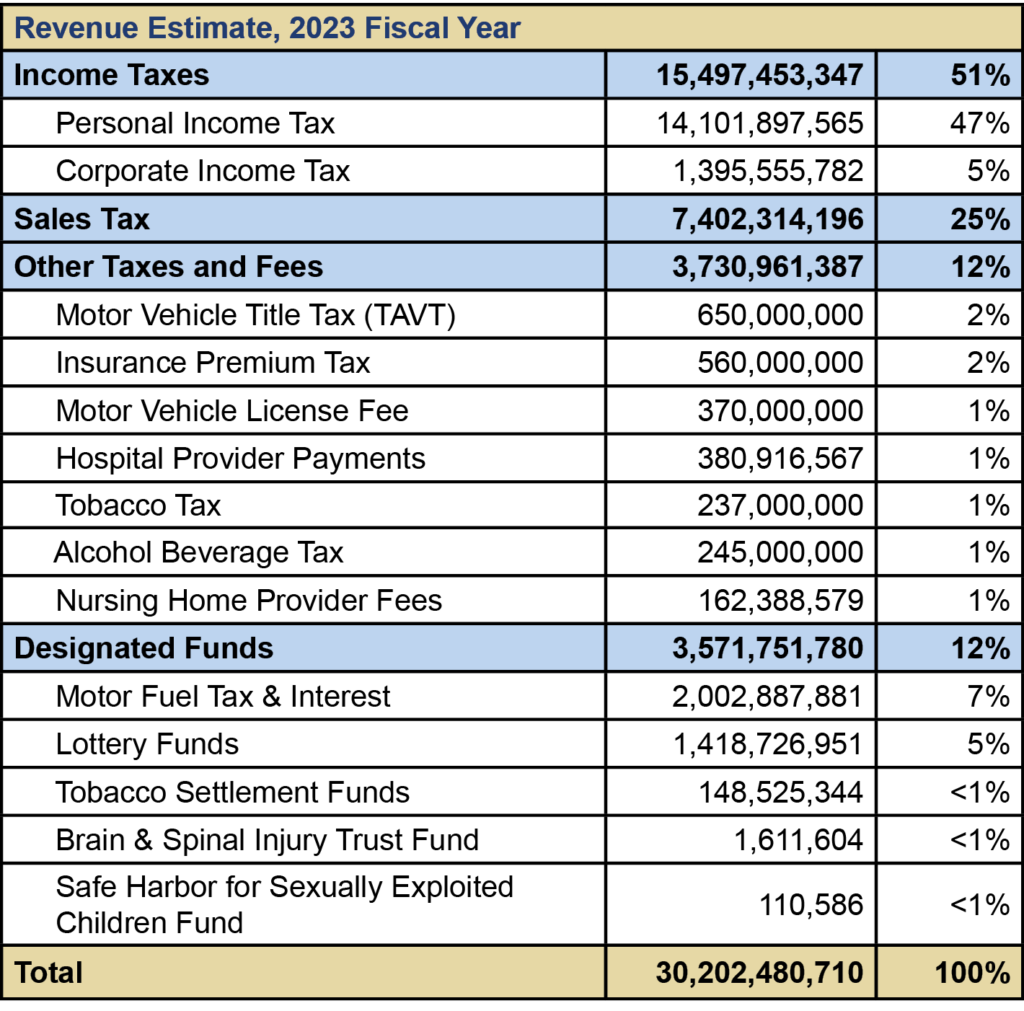

Source: gbpi.org

Source: gbpi.org

Revenue Primer for State Fiscal Year 2023 Budget and, For 2023 (tax returns filed in 2024), georgia has six state income tax rates: Georgia payroll taxes for 2024.

Source: barberfinancialgroup.com

Source: barberfinancialgroup.com

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, Yards), state tax is included in the jurisdiction rates below. The new employer rate is 2.7%, up from 2.64% in 2022.

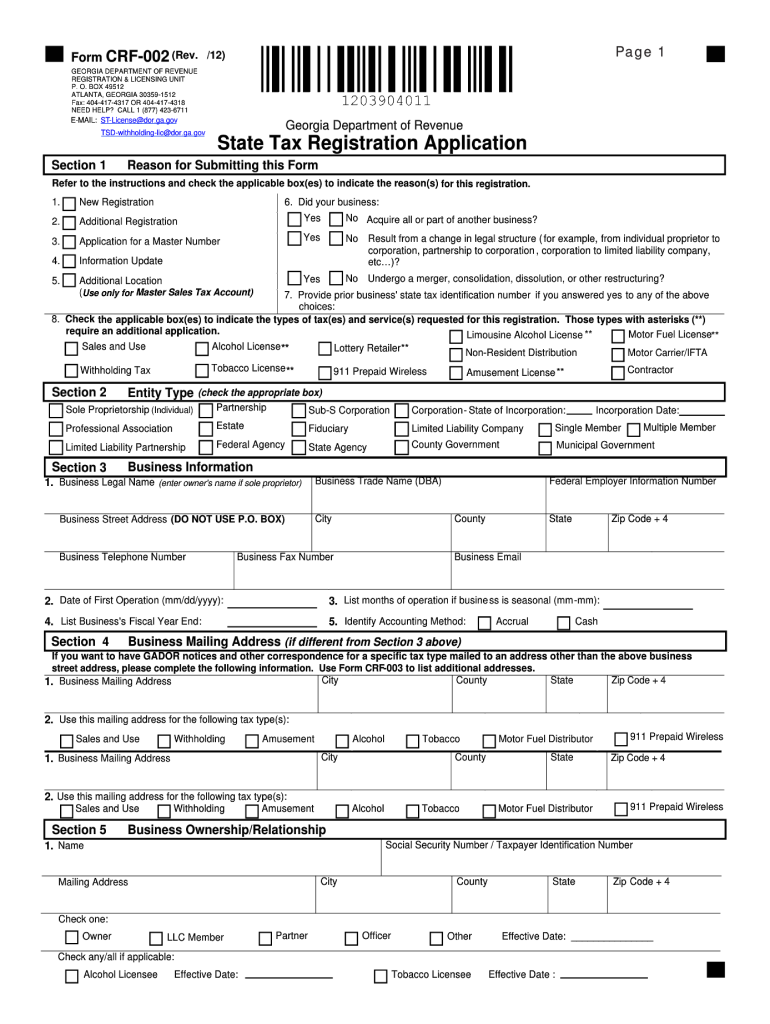

Source: www.dochub.com

Source: www.dochub.com

Ga tax form Fill out & sign online DocHub, Georgia’s 2024 withholding methods use a flat tax rate of 5.49%. Legislative changes impacting 2024 employer tax rates effective, january 1, 2024, the administrative assessment of 0.06% was reinstated under ga house bill.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, 2024 federal income tax brackets and rates in 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). For 2023 (tax returns filed in 2024), georgia has six state income tax rates:

Source: lashellahern.blogspot.com

Source: lashellahern.blogspot.com

2022 tax brackets Lashell Ahern, Georgia is one of three states to approve the move to a flat state. Legislative changes impacting 2024 employer tax rates effective, january 1, 2024, the administrative assessment of 0.06% was reinstated under ga house bill.

Source: www.marca.com

Source: www.marca.com

Tax payment Which states have no tax Marca, 2024 list of georgia local sales tax rates. With six different tax brackets, payroll in georgia is especially progressive, meaning the more your employees make, the more.

Source: makemefiler.com

Source: makemefiler.com

European Fuel Tax Rates 2023 Gasoline and Diesel Excise Duties in EU, Brian kemp wants that income tax level to go even lower to 5.39% for. If the proposal is approved, the tax rate for 2024.

Source: cyberdimension.click

Source: cyberdimension.click

Exploring New Tax Rates in Kenya Cyber Dimension, Georgia payroll taxes for 2024. Georgia residents state income tax tables for head of household filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

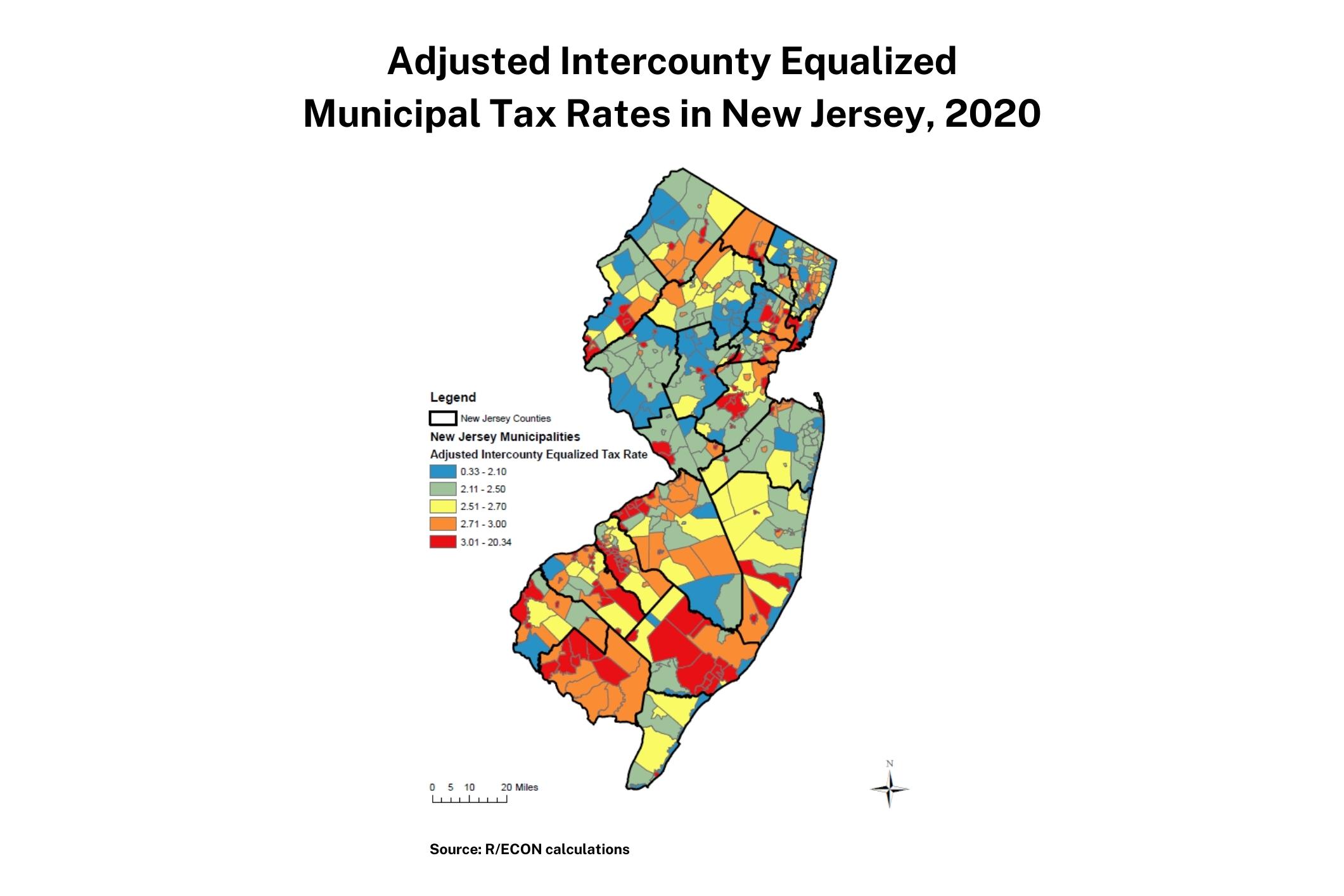

Source: policylab.rutgers.edu

Source: policylab.rutgers.edu

Report Release What Influences Differences in New Jersey’s Municipal, Georgia’s unemployment insurance tax rates for 2024 range from 0.04% to 8.1%, the state labor department confirmed to bloomberg tax on jan. Yards), state tax is included in the jurisdiction rates below.

The New Employer Rate Is 2.7%, Up From 2.64% In 2022.

Georgia is one of three states to approve the move to a flat state.

Georgia Sales And Use Tax Rate Chart.

As of monday, the new year brought in a new tax rate, lowered from an income tax of 5.75% to 5.49%.